My Journey So Far

The Alternative CV

I’ve included this very long version for those who might be interested. But its perhaps more for my benefit than yours! Self-reflection is always a useful exercise and I find the trials, tribulations, and beautiful moments of the human journey fascinating.

“Not all those who wander are lost.”

JRR Tolkien

Childhood – Berkshire and Idyllic Hampshire

I was born at the Royal Berkshire Hospital in England, the same hospital as Princess Kate, but that’s where all similarities end. My father was from a working class family in Reading, and brought up by a single mother – who later remarried – as his father Frank Butler died just 3 years after WW2. He had toured places like Africa and survived the war only to be run down by a bus when driving his motorbike one day. Hence why motorbikes were frowned upon in my family.

My grandmother – Margerie – spoilt my father rotten and when my sister and I came in to the world she did the same to us. She was one of the kindest souls I ever met, always more concerned about others than herself. And she was mesmerised by nature, often sitting in her chair looking out to the garden transfixed by the robins hopping around and feeding in her garden.

My mother’s side appeared to be more affluent but there was a lot of pain there. Her parents split up early on and she was brought up by her Welsh grandmother who sang in the Welsh Choir. It’s amazing to think that there were four generations of us living at the same time as I frequently got to meet her. Both my parents were self-made: my mother becoming an entrepreneur and my father was a finance director in the civil service.

One of the highlights of my youth was rushing around on my bike seeking adventure to far off places. I would ride literally for hours around Reading trying to get lost. Now I realise that this was a precursor to my globetrotting later in life. Around the age of 11, we moved to the Hampshire countryside. My parents had always enjoyed walks in the New Forest so at the age of 40 my father decided to recreate our family there.

We lived in a small village on the edge of the forest called West Wellow and I attended an idyllic boarding school which was based in the ancestral mansion of Florence Nightingale. When I lived in Reading I had fun on my bike and wonderful summers with my parents but I had always struggled to concentrate at school. Actually, thats a huge British understatement, I was terrified and traumatised by my early schooling – ashamed of who I was.

I subsequently realised that I assimilated information a little different from other children. I was later given labels like dyslexia or ADHD (but thankfully I didn’t embrace them). It didn’t make me less intelligent, as in fact I was ultimately able to slice, dice, and analyse that information in quite innovative ways. I just needed encouragement.

Finally at Embley Park School in Hampshire (now the Hampshire Collegiate School) I had found a House Master – Mr. Fawkes – who told me that I wasn’t stupid and could excel at school. So I did: I went from nearly bottom of the class to the top, breaking all the school records. To this day, I remind myself how just a little encouragement can help young children.

Mr Fawkes did something else for me. Unbenownst to me at the time, it turned out that he was indeed a descendent of the infamous Guy Fawkes who tried to blow up Parliament. And he passed on something a little subversive to me, he taught me about perspective. At the beginning of one course we read a play called “Making History” about a battle between the English and the Irish. The 2 accounts of the battle by the English and Irish were totally different and this got me thinking about narratives, and helped inform my entire career.

University – and moving to Japan

I left Hampshire to go to one of the top law schools in the country, King’s College London. I had won myself a place at St Peter’s Oxford, getting through the grueling exams and interviews but I slipped on one national exam in which I was forecast to get an A. Apparently there might have been a way to have still get in (as I had passed the Oxford exam) but I was quite content to experience London, which turned out to be a great decision. At Kings I was fascinated by aspects of the law and the professors quite liked me because I was able to converse about the philosophies behind it, but I really started to struggle motivating myself in the second year when it gradually dawned upon me that I didn’t want to become a lawyer! During University I had visited Hong Kong, and loved the energy, and then Japan was fascinating for its mystery. My life is a story of the oscillation between the head and the heart; now I wanted adventure again so I followed my heart in to a course in Economics and Japanese at the School of Oriental and African Studies, University of London. This had originally been a training ground for the colonial administrators, diplomats and spies when it was first established.

I was actually called by MI6 (Special Intelligence Service ) around graduation, [I think it was them – the conversation was a little opaque!) but I was already exhausted by exams and interviews at the investment banks so I never went to see them. Over time, SOAS became noted for scholars such as Bernard Lewis and writers like Jung Chang, who penned that classic about China, “Wild Swans.” Whilst at SOAS I won a Japanese Ministry of Education Scholarship to study at the University of Osaka. I think I gravitated to Japan because it was perhaps the culture furthest from my own and I think I might have read too many fantasy novels and played Dungeons & Dragons a lot, as I yearned for a mysterious odyssey in far off lands. Years later, although I was able to read, write, and conduct business in Japanese, I still thought that it was perhaps the most removed culture. Ultimately, though, my Japan experiences completely widened my perspective. Linguists call it a high context culture as much is left unsaid. This is not only because there is a strong understanding of “common knowledge” [or Jyoshiki], but also because they rely on intuition and non-verbal communication. Japanese society might be behind the West in a number of aspects but this is truly something very evolved, although at the time it was as frustrating as hell! I think it derives from the Zen philosophy and training that came from China and merged with Japanese ways.

At the University of Osaka I was mentored by a former World Bank Economist – Professor Hashimoto – and I wrote a dissertation on the Asian Financial Crisis as it was unfolding. I then went and worked for Mercury Asset Management (later bought by Merrill Lynch AM) over the summer. It was amazing to see the whole region’s economies and stock markets all fall like dominos. I was also sitting next to fund managers who had personally invested in Russia as it defaulted! Perhaps this experience and an understanding of the power of capital flows helped me predict many more crises in the future.

Wall Street to Tokyo – First Investment Advice

When I graduated I was hired by Morgan Stanley – in fact they had me on a business trip to Japan even before I had graduated! I was on their MBA track even though I didn’t have an MBA (!) but sometimes I wonder whether this was actually a blessing – I didn’t have a lot of theory to cloud my experiences and I was able to clearly observe the systemic nature of markets. After a brief period in New York and London, I was dispatched to the Tokyo branch as the youngest ex patriot employee. My first job was on the trading floor but I only had two hours of tasks each day and the rest of the time the Managing Director in charge of equities instructed me to help facilitate information flow around the organization.

I got to learn a lot about information and community – and I was always surprised how siloed organisations were – and amazed how much insight one gained from talking to people in different departments and countries.

As my boss got ill quite frequently I was often pulled on to conference calls with Managing Directors across the globe and soon I was announcing information and insights on the speakerphone across the trading floor. My role was essentially to help others do their job and they were highly appreciative, especially when I showed humility. It was a good lesson.

At Morgan I also saw the internet bubble through its entire cycle. I brought the first group of investors ever to meet with the CEO and CFO of Yahoo Japan [most of them didn’t invest so I learnt to follow my own intuition and ignore so-called experts!]. I also witnessed a great deal of insanity, with stocks rising explosively once it announced that it was doing something vaguely online. And I was always puzzled by the famous internet analyst Mary Meeker’s reports. The business models of these companies were flimsy and sometimes we would IPO these companies where the CEO was even younger than me, and even more clueless!

One of my investors gave me some very powerful advice which led me to try and become the Carl Jung of the investment world, “Look kid. You’re only 25 years old and with no experience. You are basically totally useless to me – and I appreciate that it’s not your fault – Morgan Stanley should have assigned a more seasoned veteran. However, if you follow this advice you might quickly become insightful and it could make your career. Whenever you speak to investors, listen to them carefully, take notes, and analyse their thinking.”

Another investor, who worked for George Soros and Stan Druckenmiller, the legendary macro Kings, taught me how to read credit and economic cycles and how the world was so interconnected. In Western history we don’t learn so much about the repetition and cycles of history.

In the end I concluded that investors’ thinking led everything. Even a stock or economy that wasn’t fundamentally great could have its fortunes changed if enough people believed it – at least for a certain period of time. This is because capital would flow in that direction and the capital could enable growth. George Soros wrote about this in The Alchemy of Finance but he was criticised for talking too much about philosophy. “Why don’t you write about how to make money?” reviewers at publications like the Economist lamented. A key insight was hidden in plain sight – the subtitle of the book was called “reading the Mind of the Markets.” I made it my mission to understand that “mind.”

I had some success at Morgan Stanley and then Nomura Securities as an institutional stockbroker meeting many hundreds of the world’s top investors and they paid me very handsomely as I increasingly thought like an investor, not just as a sales person trying to sell something. And although many thought it was a little strange, I spent hours analysing the US economy as it was so important to export-led Japan: in fact the big secret of investing in the Japanese stock market was to carefully look at the US credit and bond markets. So although I was based in Tokyo I had a very global view – and often read the Minutes of the Fed and other Central Banks like New Zealand, looked at global economic data and analysed geo-politics. For example, I sensed that the yen-dollar rate was set in Washington.

Tectonic Shifts – China

By 2004/5 I was becoming increasingly interested by the entire Asia Pacific and China. I had married a beautiful Korean woman – Danielle – a former Singapore Airline flight attendant, who ended up working for Samsung Electronics in Japan. Through her and many others I started to get a different non-Western perspective on Asian affairs. After China had joined the WTO in 2001, I realised that something was changing massively. I was blessed to have had the economic team of Morgan Stanley inform my early view of finance, including Stephen Roach, one of the early economists to have had access to Chinese policymakers. I read in wonder about his visits there and being hosted at the People’s Hall of China. In fact, listening to the global macro economic team at Morgan, was mind blowing to me. In the morning meetings they would discuss financial and world events from 20, 30, and 40 years ago! It really inspired me to learn history again.

The first impact of China entering the global economy was to rejuvenate the Old Economy industries across the world from the mothballed steel industries to shipping. The shipping industry was insightful for me as a learning experience about market psychology. I noticed that intra-Asian trade was taking off as well as there being a trend of multi-national companies shifting production from places like Mexico to China, implying longer shipping routes. Shipping stocks were on their backs, trading below book value in some markets like Japan in November 2002, with very few analysts tracking them, as they were so unpopular. Most investors laughed at me for recommending them, especially as a port strike in Long Beach was pushing sentiment down even more. Investors were focused on this short-term sentiment and were over-looking tectonic shifts in the global economy. Suffice to say, these stocks along with steel companies and commodities went up many hundreds of percent after this. This was something that I experienced time and time again in my career.

Interestingly in 2004 no one even wanted to buy Chinese stocks, even though the impact of China’s accession to the global economy was creating huge waves in to the global economy, and policymakers were desperately trying to modernise and stimulate the equity markets. Being based in Tokyo I was flabbergasted that even stockbrokers and investors based in Hong Kong had no interest. They would only invest in Hong Kong stocks as a way of getting exposure to China. This taught me to be careful of those too close to the action — often they cannot see the wood for the trees.

So we moved to Hong Kong on January 2006, and I headed a hedge fund desk at a major securities firm.

Predicting the GFC

I was completely spot on about the financial crisis of 2008/9 and even predicted the turning point at the bottom to the exact day. But my lack of emotional intelligence at that time meant that I actually lost money in real estate (and made some money on stocks). It was a great lesson.

I started warning people of a coming crisis that would rival 1929 Crash back in the 1Q of 2007: someone asked me what my best investment recommendation was for the year and I said “sell the auto companies and an investment bank” quite flippantly. He had wanted a buy recommendation. I was convinced that the crash in the US housing market had to result in transmission to the broader economy. And as I started to discover how unstable the financial system was in terms of leverage and the Ponzi scheme of mortgage-backed securities that were rated A, my bearishness rose. There were plenty of signs throughout 2007, culminating in the freezing of the world’s most important credit market – the London Interbank Offered Rate (LIBOR).

I even wrote to the board of the bank at which I was working, warning them of a potential crisis and urging them to consider our risk positions and also provide warnings to our clients.Eventually just before the GFC hit I moved to become a Principal at a hedge fund. I had been offered jobs in many respectable hedge funds over the years but never pulled the trigger. It was a combination of not finding a kindred spirit in terms of a flexible multi-disciplinary fund manager, and a lack of self-confidence on my part.

I still had my inner demons to face. And although I was being paid many millions of dollars and considered at times the best stockbroker in the field, I was scared of taking the risk of doing something new.

This is a problem many of my friends and associates have faced over the years: once we become specialists at something we become too afraid to move on despite being infinitely creative human beings.

Our fund actually made money in the crisis but we encountered funding issues as our sponsor lost money elsewhere in his portfolio and withdrew capital from us. I left the fund. If I had partnered with the right (compatible) person or even communicated with my partner better, I am certain that we would have made even more money that year and either prevented our main sponsor from leaving or attracted other suitors, like John Paulson did after his success. But the biggest mistake I made was to actually lose money on real estate despite warning everyone that a 1929 event was on its way. What happened was that I had made good money investing in Singapore real estate right at the bottom of that market from about 2006 onwards. Just before the GFC I thought that I could flip another couple of large luxury penthouses just in time to get out. In my arrogance I totally overlooked the fact that before prices would fall, the liquidity would freeze. The rest is history. It was a good lesson.

Dark Night of the Soul

That year, and especially after my wife and I moved to work out of Seoul, I started to have the realisation that whilst I had everything that society said I would need to be happy – the German car, the Swiss bank account, Italian clothes and a beautiful Korean wife – I was totally miserable and I was increasingly anaesthetising my feelings with binge drinking. I read in the Chinese Tao Te Ching:

“Knowing others is intelligence, but knowing thyself is true wisdom.”

I realised that I had heeded Soros’ advice and analysed the market’s mind and investors’ minds, but I never looked inside at my own. So I embarked on an inner journey that continues until this day. In the years that followed I realised that the most daunting journey for most of us is the inner one.

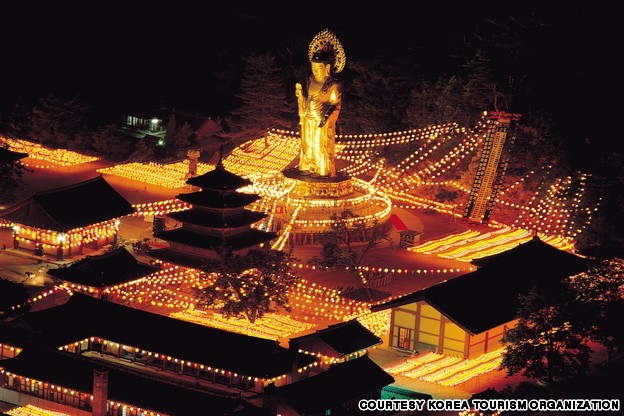

An Israeli fighter pilot once participated in a Zen retreat I attended years later and he started getting panic attacks and had to leave after just a day. He was happy to do high G force pirouettes but the thought of sitting still and looking within terrified him! In the end I found much peace in Zen meditation – by tapping in to the moment, I liberated myself from the regret and baggage of the past and the fear of the future. I also found that it enhanced my most important asset – my mind (serious Zen practitioners will know that this is a simplification, but bear with me!).

Entrepreneurship – escaping Malthus

I eventually became an entrepreneur as I realised the power of the mind and that this was a career suited to someone creative like me, especially if I wanted to be part of a movement to overcome one of mankind’s many crises. In the world of finance I found that although there were some good people, there was a culture of scarcity and fear. We were even taught at university that “economics is the study of the allocation of our scarce resources.” But I realised that the mind was limitless and so human potential had to be limitless. I escaped the world of Malthus.

The definition of entrepreneurship that I like is that it’s the pursuit of a business model with little regard for currently available resources. In this world the inner leads the outer.

By now I was doing a lot of Zen practice whilst studying the world’s major philosophies and religions. Most of them encouraged one to find the stillness within in the form of prayer, meditation or solitude.

In Zen I was taught to let of of my old ideas and hold questions.

Society and our education system pressured us to always know something but it’s when we hold a state of “not knowing”, that there is a possibility of new insight. A Japanese Zen Master who lived in San Francisco and influenced some people in Silicon Valley, once said “In the beginner’s mind there are many possibilities, in the expert’s mind there are few.” He called this “shoshin”, which has been translated as “beginner’s mind.” The gateway to this state is really being completely present in this moment and out of thought.

Currently there is a wave of “mindfulness” spreading the planet, which is very positive. In Zen we talk about moment-to-moment mind.

As a Westerner, the concept of getting out of thought was not only terrifying, it was actually stupid. Why would you want to do that?? But I learnt that there is an intelligence we can tap into when we quieten the logical left-brain. We actually have two hemispheres to the head brain and three brains in the body – the head, the heart and the gut. All of this intelligence can be accessed when we can shut one little part up! Some people call this intuition – but there might be other more appropriate names for it.

Deeper Insights

My practice also led me to realise that a modern self-obsessed lifestyle is a huge obstacle to happiness. In fact a wise Indian once said that it’s your very search for happiness that keeps you unhappy!

In Zen they suggest looking at this “I” or “me”. What is it? It’s the word that we use the most but we don’t even know what it is. And it seems to be the root of a lot of disturbances in the mind. In Christianity we talk of the “burden of self.” When one finds that this elusive “I”, which wants this or that, is merely an illusion one can constantly tap in a vaster intelligence and be more compassionate to other humans.

A friend of mine from University – Adam Lindemann – and I created Mind Fund and we invested in Silicon Valley/West Coast USA. I sat on the board go a number of start ups and learnt a great deal about management and entrepreneurship. Adam had been mentored by the current MIT Media Lab Director Joi Ito and I learnt a lot from him. We had some failures and put too much faith in good ideas, but we also backed a very self-aware leader and the investment paid off as we ended up investors in Bytedance, the world’s most valuable start-up. I departed but Mind Fund seems to have gone on to do good things.

Collective Intelligence

Whilst juggling a number of roles including investor and futurist, I dedicated some time in the realm of collective intelligence. As I started working with more and more teams as an entrepreneur I realised that one could create cultures of co-creation that were far most successful than old hierarchical structures. I worked with a UK consultancy called “nowhere” (a pioneer in the field) and studied the works of the quantum physicist David Bohm who wrote about dialogue, and worked with the Design School at Hong Kong PolyU (especially Dr. Gino Yu a world expert in consciousness and creativity) and leveraged my past experiences. Although ancient cultures have been sitting in circles for thousands of years leveraging the power of the collective, it seems that our modern civilisation is starting to rediscover this.

In recent years even Harvard Business School has just started to talk about collective intelligence. And at MIT there are some pioneers like Otto Sharmer, Bill Isaacs and Peter Senge who understand it.

I like to remind friends that Steve Jobs actually made his money on Pixar not Apple – this is a company where they actively co-create movies: intelligence and responsibility is spread out through the organisation.

Dow Theory Letters and Blue Sky

Between 2011 and 2015 I was both writing about global trends and financial markets at Dow Theory Letters and also advising one of the smartest hedge fund managers in the business about trends. Dow Theory Letters was founded by Richard Russell, who wrote a daily commentary on financial markets every single day starting in 1958. He had quite a loyal following due to his very personable writing style and honesty. His focus was on the patterns of charts in markets. I very much enjoyed writing the weekly International Investment Column.

https://en.wikipedia.org/wiki/Richard_Russell_(Dow_Theory)

The hedge fund and family office I advised on global investments kept my mind quite sharp in this period. One day I was discussing trends I was a seeing in Silicon Valley, then I was discussing the EU sovereign debt crisis and the next I was recommending acquiring real estate on Venice Beach – soon to become Silicon Beach.

Death of My Sister

In January 2015, my dear younger sister tragically passed away. I wrote this on my Facebook wall at the time:

“My dear younger sister Rebecca died suddenly this week, just four weeks after giving birth to a beautiful baby girl Isabella. We got pregnant just a month apart, and I was looking forward to sharing more time with her and the family after our baby came into the world. I am both devastated and in awe of my sister. She touched the hearts of so many people and the outpouring of grief has been overwhelming. I knew she was a beautiful person, but I never realised she was practically a saint. The Cheshire Police have been amazing and are providing an honour guard at her funeral next week.”

“Go out into the world today and love the people you meet. Let your presence light new light in the hearts of people”. ― Mother Teresa

It was a big shock and a wake up call. My last few conversations with my sister were about pursuing your heart.

Having a First Child – The Age of Gaya

Two weeks after I read the eulogy at my sister’s funeral our daughter came in to the world. Her nickname during the pregnancy was “One” – it was a play on words as “Won” in Korean means the Zen circle and it can also mean wholeness and unity. We also found out that we were pregnant whilst travelling up the stunning Highway Number One in the US. So of course she was conceived at 1 am in the morning as well! That was very interesting and this has made me want to write an autobiographical book one day called Pursuing the One. Just recently I heard that I was also born at 1 o’clock – 1pm!

We named our daughter “Gaya”. I have always been fond of the word. In Greek it means Mother Earth and James Lovelock, the former NASA scientist, coined the term Gaia Theory about the interconnectedness of the animate Earth. In Korean – my daughter is half Korean – it means beautiful field. I think we are on the edge of a new Earth. More financial crises and turmoil might be ahead of us but at the grassroots level we are seeing a shift in global consciousness. Since the last Global Financial Crisis, there has been a rise in the interest in the inner human journey and mindfulness, backed by new discoveries in neuroscience. There is also much inter-disciplinary dialogue or co-creation and it is these kinds of factors that can be said to have sparked off previous periods of human Enlightenment.

The advances in robotics, bio-tech, quantum physics are all incredible, but if we can harness the power of the human mind more then we truly could be entering a spectacular new age. But first the darkness – and I remind myself that its darkest before the dawn.

Becoming a Futurist

Maybe there’s no coincidence between the birth of my child and me truly stepping into my role as a futurist.

I often quote Schopenhauer who said that life doesn’t make sense forwards, only backwards. So although I did all these seemingly disparate things, a coherence did finally emerge. I needed a holistic education in finance, design, history, anthropology, Asia and its languages, entrepreneurship and Zen and the mind, to give me the depth to become a futurist.

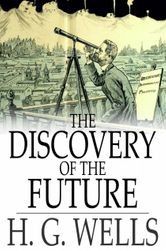

Since ancient times people have always been fascinated by the future – from Nostradamus to HG Wells in the 20th Century and to the Singularity spoken about in the 21st Century. A roomy definition of a modern-day futurist might be someone who explores possibilities and probabilities about the future. Many futurists today operate in the corporate world, or work for governments or the military, as consultants. Some observers might date the beginning of modern futurism to 1902 when the writer HG Wells gave a talk at the Royal Institution in Mayfair called “Discovery of the Future.” He discussed the knowability of the future and why it was important to study it, predicting that one day there would be professors who lecture on the future just like history lecturers discuss the past. This turned out to be true, although the field first developed in the military and corporations. During the cold war the strategist and futurist Herman Khan introduced the idea of scenarios. He thought it was his job to ‘think the unthinkable’. With scenarios, futurists explore a number of possible futures. They might assign probabilities to these futures but one of the key utilities to the exercise is to go deep into each scenario to see what would play out, and discover what ‘you didn’t know you didn’t know, but you probably should have’ – a phrase that Jerry Glenn, Founder of the Millennium Project is fond of saying.

The first well known corporation to introduce future scenarios was Shell. A futurist called Pierre Wack pioneered this effort, and he came to fame after doing scenarios which anticipated the Oil shock of the 1970s. He wrote a number of articles in the Harvard Business Review which perhaps contributed to the growth of the corporate futurist. Wack suggested that scenarios dealt with both facts and also should lead to fresh perceptions amongst leaders. Many other companies then followed Shell’s lead. Since the 1970s we also a number of Universities start to introduce future studies. I believe that Jim Dator at the University of Hawaii was one of the early pioneers. They endeavour to take a scientific and empirical approach to exploring the future. Today, Sohail Inayatullah is doing pioneering work in Australia with his Causal Layered Analysis approach.

However, I would say that there might be as many futurists as definitions, and many would include writers and science fiction writers into the fold such as Arthur C Clarke and Isaac Asimov. In a way, that’s what attracted me to the field. I could be both analytical, using a system-based and trans-disciplinary approach, and be imaginative and creative. Historically, the futurists might have been the advisors and counselors to the Kings and Queens – or Jesters, speaking uncomfortable truths! They used to speak of seers, or see-ers, and these people were able to look to the horizon, and see bigger trends and events.

Through my career I’ve been paid good money to anticipate the future and help others see the bigger forces at work. But I think the psychological dimension is perhaps more important – how do you approach the future, or how do you create those preferable futures? The World Future Society , which was established in 1966, recently cited this list of attributes as a futurist mindset:

- Adaptive and resilient in the face of change

- Willing to hold and evaluate multiple possible current realities

- Operating with an understanding that more than one reality can be evaluated simultaneously

- Conscious of how we can use foresight, hindsight, and insight to have more choice

- Empathetic to others and their views

- Interested in the technology advances of the current day, so that we can use technology to our benefit”

I actually like helping people cultivate their imagination and a futurist mindset, so I enjoy working one on one with people and not just with large organisations

Today

Project-wise my current focus is twofold. First, I am fascinated by our collective journey into the future. But not merely as a passive observer, I am a participant and I also have a 3 year old daughter. I see it as my mission to bring the ‘soul’ back into the future. So I will be exploring this in a lot more in writing – I am now writing at Intelligent HQ, Emerging Future and I am writing for Futur.io: The European Institute for Exponential Technologies and Desirable Futures.

On the writing side, I am also finishing off a book called “The Futurist” which I intend to publish soon. It’s almost like the Sophie’s World for the future – a dialogue between the Futurist and a Chinese girl Feng – about the future journey of humanity. I believe that a dialogue is a great place to explore the future as it allows greater nuance. On the surface there will be some anticipation of the future, but the deeper meaning of the book is how to befriend uncertainty and cultivate a futurist mindset.

Second, I am also doing a lot of coaching and one-to-one advising. Recently I sat on the advisory board of a top Korean tech company and I am open to advisory positions but I also think that the world already has enough futurists focused on large organisations. As I said, I feel that to avoid some of the futures warned by great visionaries and scientists like Stephen Hawking, we need to stir the human soul again. Technology alone is not the answer, its only part of the puzzle. If more of us can find our true purpose on the planet, to light that inner fire, I do believe we will move in the right direction collectively. I rarely find that someone’s true passion is to destroy the planet or blow people up. And I believe I have a gift for helping others think imaginatively about their future, find their calling and guiding them on their odyssey. There is nothing more rewarding.