Death and Rebirth

“On the day in which we celebrate the trust in a life that triumphs, I’m honored and happy to answer ‘Sì’ to the invitation of the City and the Duomo of Milan. I believe in the strength of praying together; I believe in the Christian Easter, a universal symbol of rebirth that everyone – whether they are believers or not – truly needs right now. Thanks to music, streamed live, bringing together millions of clasped hands everywhere in the world, we will hug this wounded Earth’s pulsing heart, this wonderful international forge that is reason for Italian pride. The generous, courageous, proactive Milan and the whole of Italy will be again, and very soon, a winning model, engine of a renaissance that we all hope for. It will be a joy to witness it, in the Duomo, during the Easter celebration which evokes the mystery of birth and rebirth”

Andrea Bocelli

The Italian tenor Andrea Bocelli stirred a lot of hearts on Easter Sunday when he sang in the deserted Duomo cathedral in Milan for an event named “Music For Hope”. Apparently 25 million or so have seen it. I was also inspired by his words at the beginning which are quoted above citing the possibility of rebirth, as well as a renaissance.

In fact, this might well be what is happening to our civilisation now, a death and a rebirth.

Cyles

This last week I had another pleasant interaction with Tim Littlehales, former Co-CEO of Bridge (a global consultancy where I am futurist-in-residence). We were reflecting on our society’s aversion to death or destruction or darkness. With the supermoon (see the photo above taken by my father) it was a good time to think about cycles.

When one looks at natural cycles, both death and destruction is integral to life. Life and death are two sides of the one coin. When a big tree dies in a forest, does the forest mourn the death of a tree? Or celebrate the small trees which will have more nutrients to grow and can then move into the space the big tree was taking? Without the death of the old tree, the smaller trees and plants might have been starved of light. Within the human body, as well, its considered quite normal to have both creative and destructive forces. Anabolism and catabolism are the two types of biochemical reactions which make up metabolism: where anabolism creates complex molecules from simple ones and catabolism breaks down large molecules into simpler ones. We are just afraid of these forces at other levels like society and the economy.

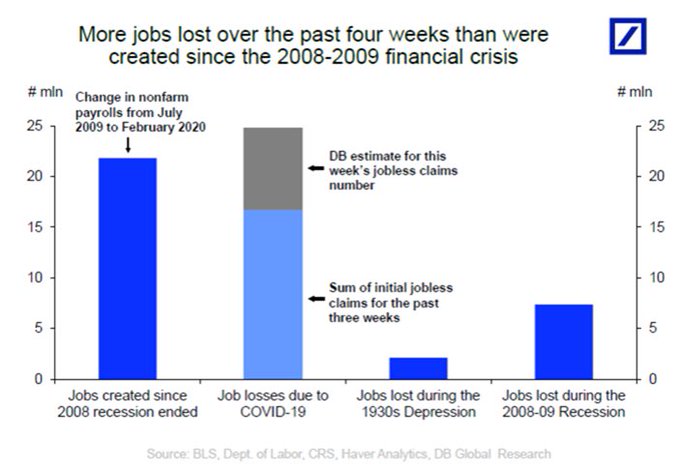

Diseases of Modern Economics

It could be said that mainstream economics for the last few decades has often focused on the command and control mentality of ironing out cycles. At least that’s my impression. The former Fed Chairwoman Yellen infamously said back in 2017 that we might not have another recession in our lifetimes. Perhaps it was our civilisation’s desire for non-stop growth at all costs. Now, things are so bad, we have one regional Fed Chairman forecasting peak unemployment in this crisis at 32%, and worse than the Great Depression. The problem is we invariably end up with much bigger crises due to our excessive tampering due to unforeseen consequences such as excessive speculation and growing wealth disparities (both partly triggered in the last 10 years by central banks’ money printing). Years ago when I hiked up Mount Tamalpais – just north of San Francisco, where the English philosopher Alan Watts used to live – my friend told me that the mountain was a tinder box as they never permitted small fires in the forest. In nature frequent small fires are considered healthy by ecologists. If you prevent these you risk much larger forest fires, which is what we saw in California in recent years. No it wasn’t just global warming, although that was a convenient excuse for politicians. I’ve also seen data showing that when politicians and central banks were less obsessed with controlling the cycles, we had frequent but less deep recessions. Just read a little by the Austrian economists and you’ll soon find data.

Anyway if you look hard enough, you’ll even find economists like Joseph Schumpeter who apparently coined the phrase creative destruction. Lots of innovation and creativity can come out of the destruction of the old. Already I am hearing anecdotes of all sorts of innovation as businesses are forced to think about new ways of doing things and the shift from atoms to electrons accelerates. The problem about this current crisis is the immense magnitude of the economic shock. We could have perhaps created a more resilient system in preparation, but we didn’t.

That all said, potentially there will be huge positive ramifications over time. Perhaps this shock was really necessary to power us in to the Post industrial Civilisation into which we needed to transition: a death of the old system and rebirth of a new one.

The Economy and Financial Markets – Winter Is Here

“With each passing day, the 2008 global financial crisis increasingly looks like a mere dry run for today’s economic catastrophe. The short-term collapse in global output now underway already seems likely to rival or exceed that of any recession in the last 150 years.”

Kenneth Rogoff, Former Chief Economist, World Bank

Ever since the last financial crisis I’ve been warning that the next one would be bigger, perhaps the biggest in 100 years or more. I also used the Game of Thrones meme – “The Winter is Coming.” Well Winter is indeed here.

As I was noting last year, the global economy was at stall speed and quite ripe for a recession something commentators like to ignore. Then came the Coronavirus, a massive exogenous shock. Once the severity of the Coronavirus lockdowns on the economy became obvious, we saw key markets in the world plummet. It was unbelievable that they took so long to respond. In the end, US stocks fell nearly 35%; in fact the S&P500 stocks experience their fastest 20% collapse in history. And the fear gauge – VIX – hit a record high, and even above the 2008 peak! More scary for some has been the massive expansion of spreads and the seizure of the credit markets, meaning that many businesses won’t be able to get access to any credit unless supported by government.

Now markets have had a vicious rebound (as I suggested they would). This is just market participants trying to see light at the end of the tunnel. I think markets are suggesting that the Coronavirus will peak out before the summer and they are responding to the trillions of dollars of asset purchases by central banks and the fiscal spending by governments. Some investors seem to think that once the virus is behind us, the economy will re-open like flipping a switch.

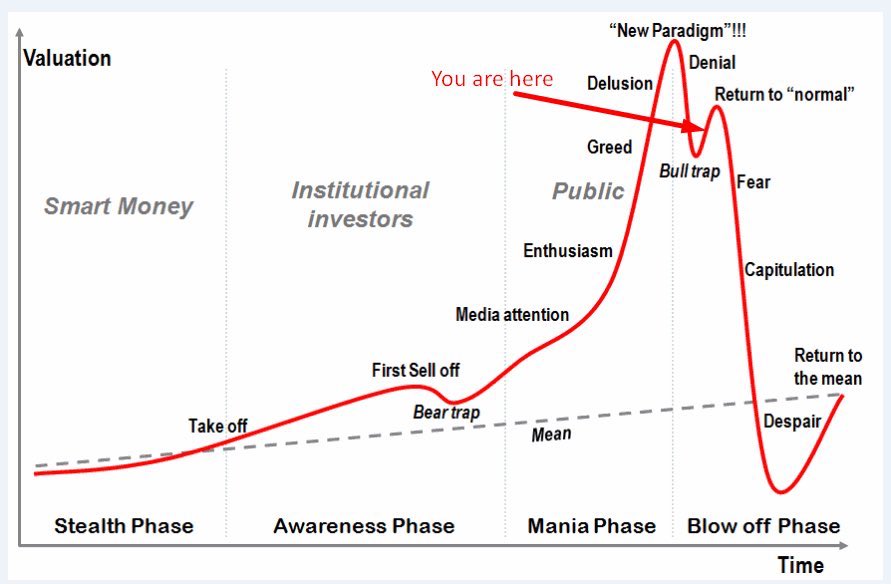

I tend to think we might be here, on this often-circulated chart:

In other recessions we saw much more significant falls in stocks. For example in 1920 to 1933 the US stock market fell 89% peak to trough. In the bursting of the Dotcom crash (which I predicted and experienced on Wall St) Nasdaq fell 67%. One might expect similarly large falls peak to trough (especially as stocks are really not cheap).

Scenarios

I don’t want to sugar coat this : this might take a significant amount of time to recover – regardless of coronavirus.

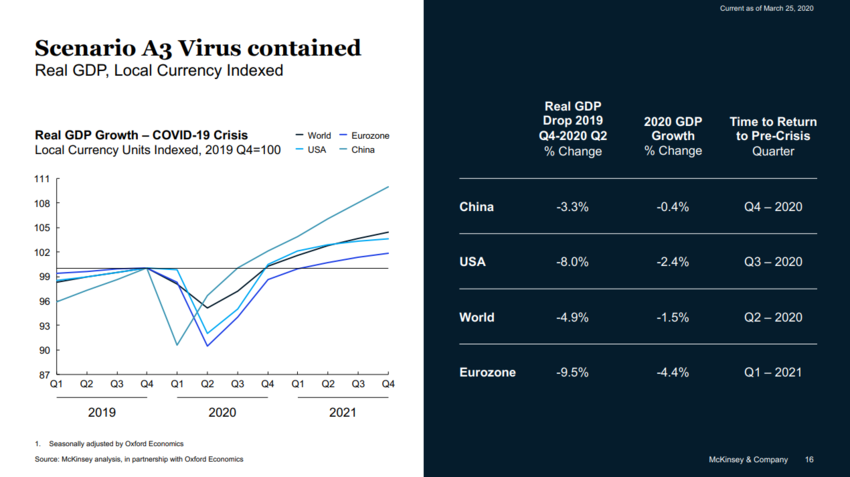

Recently McKinsey, the global consultancy, put out some scenarios. In the case of the virus being contained we will have a ‘V’ shaped recovery and the global economy be back at 4Q2019 levels within 2020! That sounds rosey to me, even if the virus is ‘contained’.

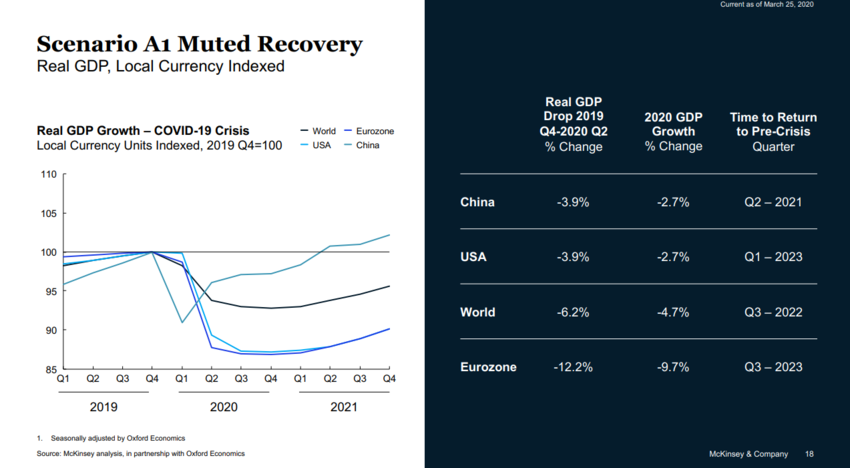

Their other scenario, more likely in my opinion, suggests it will take until the 3Q2022 for the world to recover to pre-crisis levels. The Eurozone, which is one of the most fragile regions, will take until the 3Q2023.

For an even more realistic view, I go to Nouriel Roubini. He was an amazing economist in the run up to the Great Financial Crisis of 2008-09 and one of the few people who I followed. Then I saw him speak at an event or two in Asia where we were both speakers and thought he wasn’t so provocative any more. It almost seemed that he had been promoted into the ranks of the mainstream elite and could no longer upset the applecart. I was pleased to see him not pulling any punches over the recent shock:

“Every component of aggregate demand – consumption, capital spending, exports – is in unprecedented free fall. While most self-serving commentators have been anticipating a V-shaped downturn – with output falling sharply for one quarter and then rapidly recovering the next – it should now be clear that the COVID-19 crisis is something else entirely. The contraction that is now underway looks to be neither V- nor U- nor L-shaped (a sharp downturn followed by stagnation). Rather, it looks like an I: a vertical line representing financial markets and the real economy plummeting.”

In this article he suggests a severe recession is baked in, the only question is whether we get a Greater Depression.

It is not going to be easy to just flip a switch and get the global economy going given all the interconnected feedback loops.

When looking at the economy it would seem we will be in a so-called “Depression” for a couple of years, with various rolling crises. The well-known macro investor Ray Dalio seems to agree with this assessment, which doesn’t particularly surprise me given we both trained in the same way of analysing economies. He did an excellent TED interview this last week.

I believe that over the next few years, the global economy will be faced by:

- Further waves of Covid-19 – there is going to be much disagreement over the timing of re-opening of economies. Some nations will try and do it in steps or start issuing cards proving immunity/antibodies etc. It will get messy. There might be fights over forced vaccines and civil rights, feeding in to point 6 (below).

- Animal spirits in the economy – have already been shocked and already in just a few weeks the US has seen a losss of 19 million jobs. Also bear in mind that in the world’s largest economy, 40% of Americans only have $400 in savings or less so government checks won’t last long. Other economies will have their own issues, especially emerging markets.

- Financial contagion – we’ve just witnessed the biggest speculative bubble in history. Central Banks are trying desperately to prevent this from unwinding with huge purchases of various assets. There were problems last year even before coronavirus keeping it all together (repo market crisis of September).

- Resumption of de-globalisation – multinational companies are trying to mitigate risk by moving out of China. The new ‘iron curtain’ which some have warned about is going to confuse businesses.

- Geo-political tensions between US and Chia erupt further: you can already see the blame game on Covid-19 building up. US-China or even the West-China might blow up in unexpected ways, especially as some hawks in the US worry that China could emerge as No 1 from this crisis. There could also be huge positioning around the creation of a new monetary and world order.

- Civil unrest and political instability – this is likely to intensify before it gets better. Already politics was destabilising with the growing gap between the rich and the poor, and a collapse in trust. Governments are going to struggle with restructuring debt (who gets bailed out) and the culture wars will intensify especially around key elections like the US Presidential election.

- Government debt pushes hits its limits – an advanced nation like the US might be about to do deficit spending equivalent to 10% of GDP for a year or two, but how long until faith in the fiat currency falls? Typically economies eventually see hyperinflation when spending becomes too big.

I might well write an article dedicated to the economy and financial markets later as these are huge over-simplifications. Anyway, I don’t write this to scare you. Depression doesn’t mean a total seizure of all economic activity. As the lockdowns are lifted, we will see a resumption of activity but just at lower levels than before, whilst the new system gets built and we go through the messy process of restructuring. And this is the really exciting part.

Zooming Out

My sense is that my long held vision of the future still holds: a breakdown of our current civilisation from 2012-2022 with a re-emergence 2023-2033. But very slowly at first and it might not really feel like it until 2025 and beyond. I always foresaw 2020-2025 as a particularly intense period of change catalysed by crisis.

For years change makers around the world have been saying that our system doesn’t work, or perhaps only works for the 1% or the 0.1%. An immense catastrophe has hit the global economy – almost like an asteroid -and this gives us an opportunity for a reset and the creation of a new society and civilisation which is both more human-centred and ecological but yet still embracing the advanced technologies of the Fourth Industrial Revolution. The institutions we’ve relied on since for the last 200-300 years (as well as the newer ones built post war) are no longer fit for purpose in a Post Industrial Society. But for the right ones to emerge we will need new ways of seeing, that is a paradigm shift to a new cosmology.

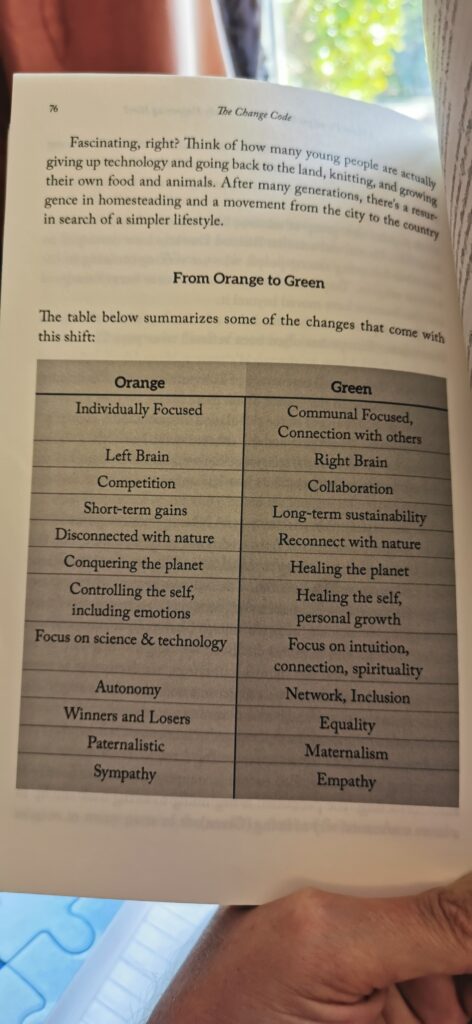

If you use existing models and maps out there, this might be explained by something like Spiral Dynamics based on Clare Graves framework on evolutionary consciousness . One might say we will see a shift from Orange to Green. From the book “The Change Code”:

There are many other maps and ways to explain the cosmological shift which might be upon us and I’ll explore these in my blogs and upcoming book.

What To Do?

Here are some brief thoughts as this will be the topic of many of my blogs, and my coaching sessions with clients.

This is a very challenging time for many people. For some the priority might be merely to survive and put food on the table. I recognise this and this is why my advice might be best tailor-made.

Where possible, for individuals it’s a time to embrace your calling as I’ve suggested in a recent article for Embassy of the Future. Embrace your unique gifts and share your creative genius — do anything but binge watch Netflix all day and avoid reality. Some relaxation time is good though.

And for businesses this is indeed a time for both innovation (many great companies emerged from recessions) as well as doubling down on your social mission. Those people and organisations without a North Star are probably going to suffer the most in all this uncertainty.

So Winter is here. But winter – just like the yin in Chinese Taoism – is a time to look within, to become creative and to try new things. Given what’s happening I still think it’s an apt metaphor. Instead of fighting the cycles of life we need to learn to embrace them. Work with the winter or yin energy, and prepare for the Spring. Winter can, if we let it be the death, ready for a rebirth just as many Christians were celebrating Easter this last weekend.

At the civilizational level a new Renaissance could emerge, a truly new human-centred and creative period of human history something I would like to explore at Embassy of the Future and on this website. When I listened to Andrea Bocelli’s beautiful music on Sunday, I truly believed it was possible.

I am coaching a small group of change makers, leaders and CEOs through this challenging period. Please reach out if you need support.